In-Depth Guide to Maximizing Construction Payment Management

I have seen profitable projects turn stressful for one simple reason: construction payment management was treated as an afterthought.

On paper, the margins looked solid with tight estimates and schedules making complete sense in the beginning. But once the job moved into active construction, payment timelines slipped, invoices piled up, and subcontractors started calling before accounting had answers. That is when it becomes clear that managing payments is not an administrative task but an operational control.

In my experience, payment workflows only function properly when they are part of a larger construction financial management structure. Estimates must tie to budgets. Budgets must tie to billing schedules. Change orders must flow directly into updated payment applications. If those pieces live in separate systems or spreadsheets, friction builds quietly until it shows up as delayed draws or strained vendor relationships.

Therefore, in this guide, I’ll break down how construction payment management actually works in the field, where it tends to fail, and what processes help builders stay in control from contract to final payment.

Table of Contents

- Understanding Construction Payments

- The Construction Payment Lifecycle Explained

- Common Construction Billing Structures (And When to Use Each)

- The Role of Automation and AI in Payment Accuracy

- 4 Real Risks That Delay Construction Payments

- Payment Terms in Construction Contracts

Understanding Construction Payments

In my experience, construction payments are control points rather than mere transactions.

At a basic level, construction payments refer to the financial flows tied to labor, materials, subcontracted work, and contractual milestones. In practice, they determine whether a project maintains momentum or begins to stall under cash pressure.

Why Construction Payments Are Structurally Complex

What makes payment management in construction different is the number of moving parts involved. A typical project may include:

- The owner or developer

- The general contractor

- Multiple subcontractors

- Material suppliers

- Consultants and inspectors

- Sometimes lenders or funding partners

Each party operates under specific contractual obligations, billing requirements, and approval conditions. When those layers are not aligned, payment friction appears quickly.

Payment schedules are also rarely straightforward. They often involve progress payments tied to a percentage of completion, milestone-based billing, SOV breakdowns, and final payment contingent on inspections and documentation.

Construction retainage adds another layer. Many contracts allow owners to withhold a percentage of each payment until substantial or final completion. While this protects the client, it directly affects contractor cash flow and must be tracked carefully.

Construction payments sit at the center of construction financial management. When structured clearly from the start, they reduce disputes and protect liquidity. When treated casually, they introduce avoidable risk.

The Construction Payment Lifecycle Explained

Construction payments follow a sequence. When that sequence is aligned early, billing stays predictable. When it breaks, disputes and delays follow.

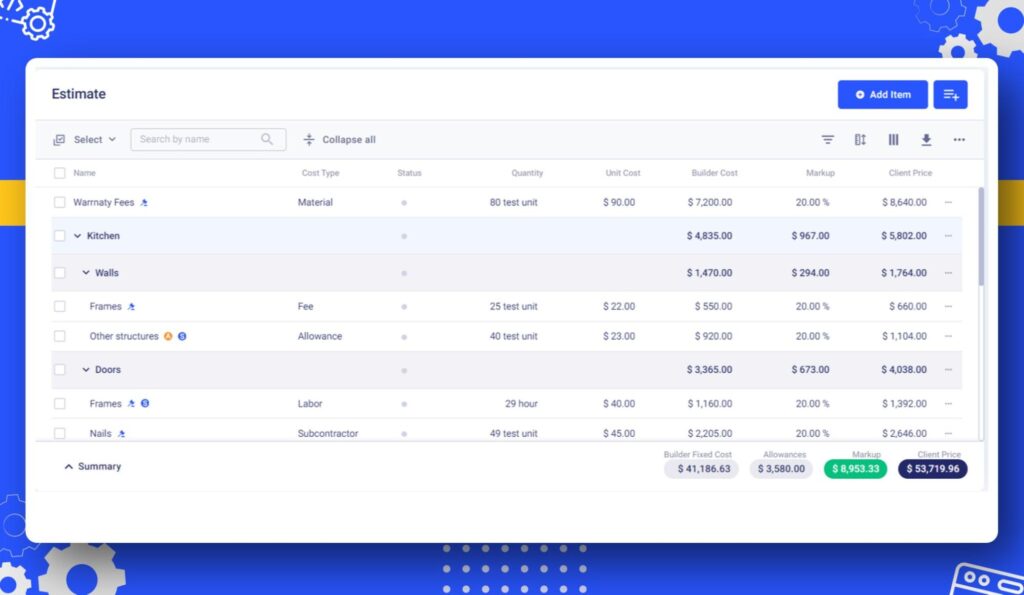

From Estimate to Schedule of Values

Payment accuracy begins before the contract is signed.

The estimate sets the financial baseline. Once the project moves into contract form, that estimate must translate into a structured Schedule of Values. If cost categories are poorly defined or inconsistently grouped, billing confusion starts immediately.

A clean transition from estimate to Schedule of Values ensures:

- Clear cost breakdowns

- Logical billing percentages

- Easier progress verification

- Fewer disputes over scope allocation

If this step is rushed, payment problems surface later.

Progress Billing and Pay Applications

Most construction projects rely on progress billing tied to the percentage of completion.

Each billing cycle typically requires:

- Updated completion percentages

- Supporting documentation

- Change order adjustments

- Retainage calculations

Errors in calculation, incomplete backup, or unclear scope descriptions often delay approvals. Consistency across billing cycles matters more than speed.

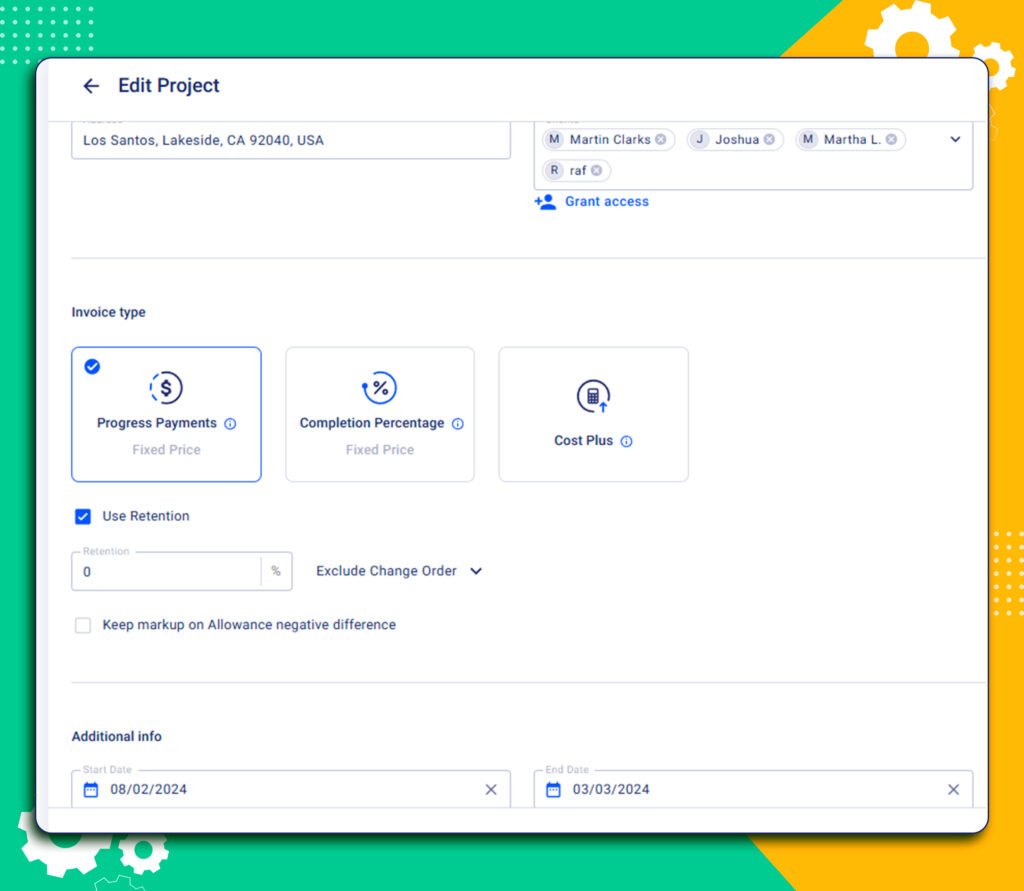

Retainage and Its Cash Flow Impact

Retainage is standard practice in many contracts. A percentage of each payment is withheld until substantial or final completion.

While it protects the owner, it creates cumulative working capital pressure for the contractor. Over a long project, retained funds can represent a significant portion of total revenue. Without active tracking, liquidity strain builds quietly.

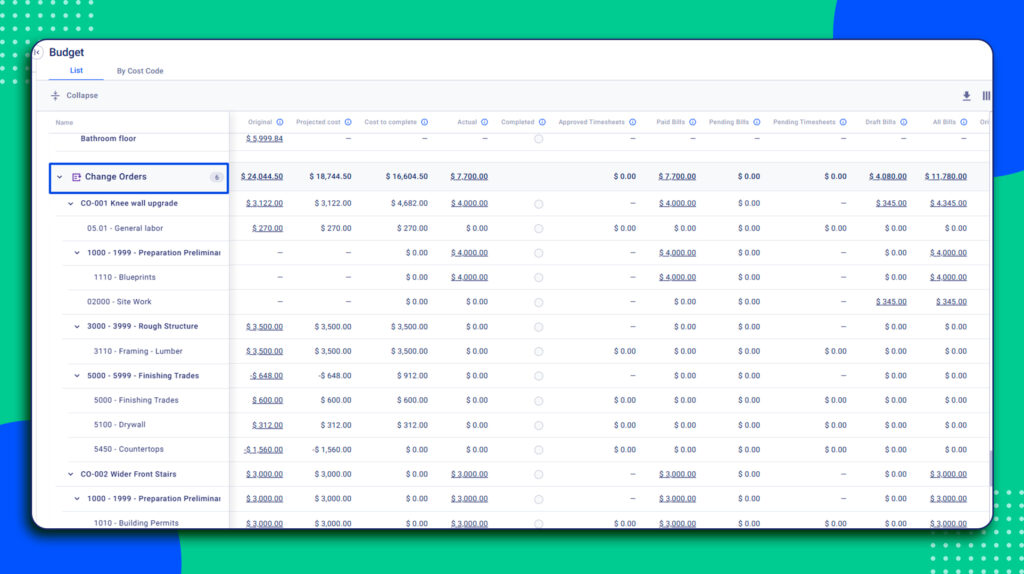

Change Orders and Billing Adjustments

Construction change orders disrupt payment rhythm if not integrated immediately.

When scope shifts but billing structures are not updated in real time, gaps appear between performed work and billed amounts. This leads to underbilling, disputes, or delayed approvals.

Change orders must flow directly into:

- Updated budgets

- Revised Schedule of Values

- Adjusted pay applications

Delay in documentation almost always translates into delayed payment.

Final Payment and Closeout Requirements

Final payment is rarely automatic. It typically depends on:

- Completion certifications

- Punch list resolution

- Lien waivers

- Final documentation packages

Projects often stall at closeout, not because work is incomplete, but because documentation is fragmented.

The construction payment lifecycle is not complex by design. It becomes complex when financial structure and operational execution are disconnected.

Common Construction Billing Structures (And When to Use Each)

The construction billing structure determines how revenue enters the project. It influences cash flow timing, risk allocation, documentation burden, and dispute exposure. The same project can perform very differently depending on how payments are structured.

Lump Sum (Fixed Price) Contracts

The most basic type of construction contract is the lump sum contract, which is the same as a fixed price contract. Such contracts set one fixed price for all the work, making them common in construction.

Most contractors have likely entered into several lump-sum contracts in the past. Despite the simplicity of the one-price formula, however, lump sum contracts have a few advantages and disadvantages.

Benefits

- Simplified bidding: Owners and general contractors can select a contractor more easily by naming a total price rather than submitting multiple bids.

- Potentially high-profit margins: Because the project price is set, finishing the work under budget means contractors can keep the savings.

Risks

- Costly miscalculations: As there is only one set price, any unexpected issues during the project result in reduced profit margins.

- Increased risk for larger projects: Any setbacks from subcontractors are paid for out of the lump sum price, making larger projects more risky.

Time and Materials (T&M) Contracts

Time and materials contracts are preferred for projects where the scope of work is not well-defined, as opposed to lump sum contracts. Such contracts help reimburse contractors for the cost of materials and establish an hourly or daily pay rate. Time and materials contracts offer certain benefits and drawbacks that both parties cannot neglect.

Benefits

- More agile: With customers reimbursing for time and materials, unexpected delays, roadblocks, and changes to scope are covered.

- Simple negotiations: It is simple to set rules for what materials will be covered and what the hourly wage will be.

Risks

- May not reward efficiency: With time and materials contracts paying by the hour or day, there’s no real incentive to finish a project early. Therefore, it is common to stipulate a bonus for finishing ahead of schedule.

- Potentially time-consuming: It is not an easy task to log each and every material cost on a project, and failure to provide an accurate number upon completion results in lower profit margins.

Owners bear a considerable amount of risk with time and materials contracts, given the unpredictable nature of any given construction project. They must pay the contractor for any unexpected costs, changes, or time overruns that occur during the project, which may cost them more than they initially planned for. A time and materials contract best suits projects that lack a well-defined scope of work.

Cost-Plus Contracts

Cost-plus contracts, also called cost-reimbursement contracts, involve the owner paying the contractor for the project costs incurred plus a profit amount, which may be a percentage of the total project cost.

These costs may include direct costs such as labor and materials, indirect costs such as travel, insurance, or overhead, and profit. Below are the pros and cons of using a cost-plus contract for construction projects.

Benefits

- Flexible and adaptable: Contractors can accommodate design changes during the project, and owners know they will pay for the additional time or materials required for those changes.

- Handles miscalculations: Inaccuracies in the initial bid are less critical than they are with lump sum contracts.

Risks

- Difficult to justify some costs: Contractors need to justify all costs, and some expenses, such as administrative costs or mileage, can be difficult to justify for reimbursement.

- Upfront material costs: Since cost-plus contracts work on reimbursement, paying more than expected for materials could cause a shortage of funds for the rest of the project. In cost-plus contracts, most of the risk is borne by the owner. The contractor is paid for all project costs, and the owner bears any unexpected expenses.

Best for: Projects that require a lot of flexibility and creativity.

Unit Price Contracts

Unit price contracts are measurement contracts, measure and pay contracts, or remeasurement contracts, which break down the total work required to complete a project into distinct units. Instead of providing an estimate for the project as a whole, the contractor gives the owner a cost estimation for each unit of work.

Unit price contracts are ideal for projects that rely heavily on material costs and are repetitive, and the extent of the work required is not evident before the project begins.

Benefits

- Simplified Invoicing: As the price of each unit is pre-determined, owners can easily comprehend the cost of each item that goes into the final price of the contract.

- Consistent Profit Margin: Any additional work required can be added as another pre-priced unit, making it easier to manage change orders and other changes to the scope of work.

Risks

- Difficult to Predict Total Volume: Owners may end up paying more than they expected if the number of units needed to complete the project isn’t immediately known.

- Remeasurement can delay payment: Payment can be slowed down as the owner must compare the cost of each unit with the overall project cost.

Best for: Projects with repetitive tasks where it is difficult to determine the amount of work needed.

Guaranteed Maximum Price (GMP) Contracts

Construction contracts with a Guaranteed Maximum Price (GMP) determine a cap on the contract price, which ensures that the property owner won’t have to pay more than the contract price.

The contractor should cover any labor or material costs exceeding the cap. In some cases, you can attack a GMP clause on another type of contract, like a cost-plus contract.

GMP contracts are commonly used in construction projects with few unknowns, such as the construction of a retail chain. Here are the advantages and disadvantages of using Guaranteed Maximum Price contracts.

Benefits

- Streamlined bidding and financing: The final contract price allows quick bidding and makes financing easier since the lenders know the maximum project cost in advance.

- Incentivizes savings: The fixed overhead cost encourages contractors to reduce expenses and finish the work ahead of schedule, with the owners sharing any cost savings with the contractors.

Risks

- Tough for contractors: These contracts require the contractors to pay for cost overruns if the contract price maximum is exceeded.

- Prolonged negotiations: Contractors may try to increase the maximum price of the contract to protect themselves from exceeding the price cap, potentially prolonging negotiations.

Best for: Construction projects with a limited number of unknown variables and for incentivizing contractors to complete the project within budget and ahead of schedule.

The Role of Automation and AI in Payment Accuracy

Payment errors rarely happen because someone forgot to send a client invoice. They happen because financial data lives in disconnected places.

When estimates, budgets, change orders, and pay applications are managed separately, inconsistencies build quietly. Percentages do not match. Approved changes are not reflected. Retainage is miscalculated. By the time the pay application reaches the owner, corrections are already required.

Automation reduces structural friction.

At a practical level, digital payment workflows help by:

- Pulling billing values directly from approved budgets

- Updating the Schedule of Values automatically when change orders are approved

- Calculating retainage consistently across billing cycles

- Flagging discrepancies between billed and completed work

- Tracking approval timelines in real time

The objectives are speed and consistency.

AI construction software introduces another layer of control. Instead of reacting to errors after submission, AI-driven systems can analyze patterns before billing goes out. They can detect unusual variances, incomplete documentation, or mismatches between progress percentages and cost allocations. That early visibility prevents rejections and shortens approval cycles.

In construction, payment accuracy is financial stability. Automation reduces manual dependency. AI reduces blind spots. When AI billing is structurally aligned with real-time project data, fewer surprises reach the client, and fewer corrections slow the cycle.

4 Real Risks That Delay Construction Payments

Payment delays rarely happen without warning. In most cases, the signals appear earlier in the workflow. The problem is that they are often ignored until a pay application is rejected.

Here are four risks that consistently slow construction payments.

1. Incomplete or Inconsistent Documentation

Owners and lenders do not approve payments based on intent. They approve based on documentation.

Missing backup, unclear percentage calculations, outdated change orders, or incorrectly structured Schedule of Values entries create friction. Even small inconsistencies force review cycles to restart.

Payment accuracy depends on disciplined, repeatable documentation standards.

2. Approval Issues

Construction billing often requires layered approvals. Architect certification, owner review, lender sign-off, and internal accounting checks can all sit in sequence.

If submission timing is inconsistent or supporting data is unclear, approvals stall. The delay may not be due to disagreement, but to administrative backlog.

Predictable billing cadence and clear submission packages reduce these bottlenecks.

3. Scope and Change Order Misalignment

Scope shifts during execution are normal. What creates delays is the failure to integrate those changes into the billing structure immediately.

When change orders are approved but not reflected in updated budgets and pay applications, underbilling or disputed line items appear.

Owners question the amounts.

Contractors defend the scope.

Payment slows.

Change documentation must move at the same pace as field decisions.

4. Lien and Compliance Exposure

Subcontractor lien releases, conditional waivers, insurance certificates, and compliance documentation are often required before payment is released.

If these documents are incomplete or poorly tracked, payments are withheld regardless of progress completion.

Payment flow depends not only on work performed, but on risk clearance.

Construction payment delays are rarely random. They are structural. When financial data, documentation, and approval processes are aligned early, most of these risks can be controlled rather than managed reactively.

Payment Terms in Construction Contracts

Construction contracts include payment terms that outline the terms and conditions of payment for work completed. Payment terms in construction contracts generally define the schedule of payments, payment methods, and any penalties or incentives related to payment.

The most typical payment schedules for contractors are payment in full upon completion of the work, payment in installments based on the completion of specific stages of the project, or a combination of both. Payment terms usually define when each installment is due and any penalties for late payments. Additionally, payment methods may include checks, direct deposit, or electronic funds transfer.

Incentives and penalties are also common elements of payment terms in construction contracts. Incentives can be awarded for early completion, meeting or exceeding project goals, or staying within a certain budget.

Penalties may be assessed for late completion, exceeding the budget, or failing to meet certain performance metrics.

It’s important to review and understand payment terms in a construction contract before agreeing to them. This will help avoid disputes and misunderstandings. For contractors, payment terms should be negotiated carefully to ensure that they are practical and achievable. For clients, payment terms should be clear and reasonable to ensure that the work is completed to satisfaction.

Overall, payment terms in construction contracts are essential to managing successful projects. By setting clear payment expectations, contractors and clients can ensure that work is completed on time, within budget, and to satisfaction.

The Bottom Lines

In summary, construction payment management is a critical aspect of any construction project. The inability to effectively manage payments can lead to project delays, financial loss, and disputes between parties.

Here are the key takeaways from this article:

- Payment disputes, change order disputes, delays, and unauthorized payments are common issues that can be avoided with effective construction payment management.

- Preparing payment schedules, documenting everything, and following the standards are best practices that can help you manage payments effectively.

- Advanced construction management software, can provide a range of tools for effective payment monitoring, including financial tools with integrations, scheduling, and document management.

Thus, with the right approach and tools, construction payment management can be an effective process that ensures timely and accurate payments, reduces disputes, and promotes successful project outcomes.

How Long Does a Typical Construction Payment Cycle Take?

Most commercial contractors operate on a 30-day billing cycle, but the actual timeline often extends to 45-60 days once review, approval, and fund release are factored in. The cycle length depends on contract terms, documentation quality, and approval layers.

Can Construction Payments Be Accelerated Without Changing Contract Terms?

Yes, but only through process improvements. Consistent billing schedules, standardized documentation packages, and faster change order integration can shorten approval timelines without altering contractual payment terms.

How Should Retainage Be Tracked During a Project?

Retainage should be monitored cumulatively across all billing cycles, not just per invoice. Tracking total retained amounts alongside projected release timing helps prevent unexpected liquidity pressure near project completion.